Current crypto projects and funds lack an efficient tool to manage their assets and relationships with investors transparently, and investors have no real control of what is happening with their funds inside the project or fund. Investors transfer their assets at their own risk using ineffective legal contracts with no real protection or even not using any agreements at all.

Founders of crypto projects are not motivated to develop their projects after they successfully raised funds and sometimes do exit scams such as rug pulls or just imitating project activity with no real search of real customers and product-market-fit. Unfortunately, investors are not protected from either of these activities now. Since the current legal system has proven to be costly, ineffective, and not safeguard investors but adding headaches to the founders, another solution needs to be discovered.

Investment DAOs can address the lack of transparency and align information asymmetry and motivations between investors and fund managers, bringing more control to investors and protecting them from malicious actions performed by bad actors.

Current DAO constructors lack mass adoption since they are too general and do not satisfy business or community needs. To develop tailored DAO for a specific project or fund, it must create from scratch, which is costly and ineffective.

THE PROJECT

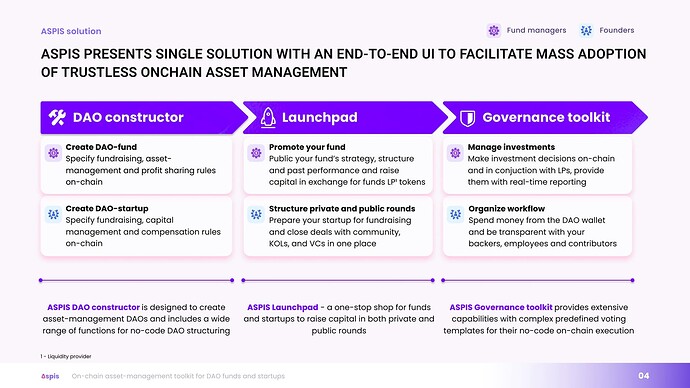

ASPIS presents a constructor for asset management DAOs (DAOs that store community funds such as funds or project’s treasury of tokens and raised funds). Using our intuitive UI, asset managers can deploy their DAO with all specific parameters for voting, onboarding, and offboarding rules and fees with irreversible on-chain execution.

On ASPIS, investors can track the performance and operations of the DAOs they’ve invested in and start or participate in critical decisions of the DAO, such as controlling tools for DAO managers (allowlist wallets they can interact with using DAO capital or putting limits on monthly spendings). Rage quit and safety measures are also included in basic DAO mechanics and will be adopted by all DAOs launched on ASPIS.

Investors can browse through all DAOs deployed with ASPIS constructor and choose funds and projects they want to join, knowing that all DAOs built on ASPIS are safe and have control over their invested capital.

KEY ASPIS BENEFITS:

- Fully on-chain governance. All voting happens on-chain, and all results are commissioned on-chain — for example, vote to propose a new transaction or to change contract parameters.

- No coding expertise is needed. You can deploy your investment club or project without the need to develop complex DAO contracts.

- Customized DAO modules. Add functions on the go as you will need them. Make your DAO transition smooth and customized to your own needs.

- One-stop-shop for DAOs. Create your DAO with ASPIS Deployer, Raise funds on ASPIS DAOPad, Vote and manage your assets on ASPIS Dashboard

ROADMAP

PROJECT LINKS

- Website: @aspis | Linktree

- Pitch: DocSend

- App: https://app.aspis.finance/

- Demo video: https://youtu.be/Au95WZs0gHA

- Blog: Aspis Protocol

- Instruction how to create DAO: https://info.aspis.finance/

- Twitter: https://twitter.com/AspisProtocol