Renzo - The EigenLayer Liquid Restaking Hub

Introduction

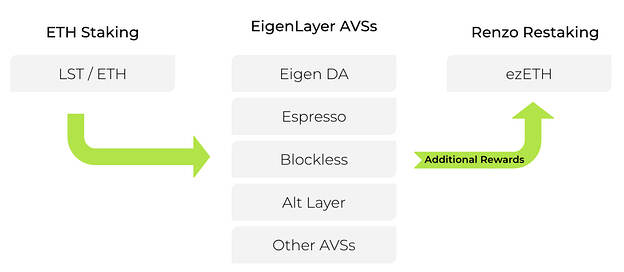

Renzo is a Liquid Restaking Token (LRT) and Strategy Manager for EigenLayer. It is the interface to the EigenLayer ecosystem securing Actively Validated Services (AVSs) and offering a higher yield than ETH staking. The protocol simplifies all complexities for the end-user and fosters seamless collaboration between them and EigenLayer node operators.

What is EigenLayer?

Eigenlayer simplifies collaboration between innovators and Ethereum’s stakers and node operators, enabling multiple parties who lack mutual trust to collaborate and achieve meaningful outcomes. By providing a straightforward means to leverage Ethereum’s ‘decentralized trust’ module, Eigenlayer promotes open innovation, eliminating the necessity for protocols to establish their validator set and granting easy access to Ethereum’s computational and financial resources.

How do LRT and ezETH work?

For every LST or ETH deposited on Renzo, it mints an equivalent amount of ezETH.

ezETH is the liquid restaking token representing a user’s restaked position at Renzo. Users can deposit native ETH or LSTs and receive ezETH.

Rewards

- ezETH is a reward-bearing token similar to cTokens

- The underlying restaking positions earn rewards which are reflected in the price of ezETH

- Rewards are expected in ETH, USDC and Actively Validated Services (AVSs) reward tokens.

- This means the value of ezETH increases relative to the underlying LSTs as it earns more rewards in AVS tokens

- To mint ezETH, simply go to renzoprotocol.com/restake and stake your ETH or LSTs

Withdrawals

- Depending on the restaking strategies deployed, unstaking will take a minimum of 7 days, primarily due to EigenLayer unstaking requirements, but will vary depending on each AVS.

- If the deposits and withdrawals are balanced, the rewards are equally distributed regardless of the asset being withdrawn.

- If the deposits and withdrawals are unbalanced, while the principal will be withdrawn in whole the rewards are different for each asset incentivizing the balance based on the jump rate model

Transfers

- Please note, ezETH withdrawals are not enabled. You are encouraged to supply liquidity or sell ezETH on Balancer, that offers a superior mechanism to convert ezETH into ETH for most cases. Visit the ezETH/WETH Balancer Pool.

Fees

- Renzo passes 100% of any EigenLayer rewards

- Renzo is built to be prThe fees will be split between protocol reserves (treasury) and Renzo node operators

Primary on-ramp / off-ramp for Ethereum restaking, using a combination of smart contracts and operator nodes to secure the best risk / reward restaking strategy.

Benefits for Metis Ecosystem

Metis plans to partner with EigenLayer both to adopt EigenLayer as its Data Availability provider, and to enable dual-layer liquid staking on the Metis network, a first for any L2. At the same time, Metis is rolling out a Liquid Staking Blitz, where it’s courting top liquid staking protocols to deploy both liquid-staked ETH and liquid-staked METIS on the Metis network, with liquid-staked METIS being paired with Metis’ soon-to-launch decentralized sequencer. Renzo will thus pair with EigenLayer to enable liquid restaking of both ETH and METIS on the Metis network.

Benefits for Users

- Users can hold ezETH in your wallet to collect rewards, swap or supply ezETH on DEXs, or participate in DeFi opportunities as ezETH is integrated into more DeFi applications

- Users can restake as little or as much ETH as they want, or stake LSTs according to the maximum cap amount, set by Renzo

- Renzo passes 100% of any EigenLayer points

Audits

Renzo has gone through comprehensive audits:

Links

Website: https://www.renzoprotocol.com/

Docs: Intro - Renzo Protocol

Twitter: https://twitter.com/RenzoPr0tocol

App: Renzo

Github: Renzo-Protocol · GitHub

Blog: Renzo Protocol

Telegram: Telegram: Contact @RenzoProtocolChat