INTRODUCTION:

The much anticipated deployment of the Metis sequencer technology is set to catalyze substantial METIS token locking, spurring demand for METIS LSTs. Althea Finance harnesses the untapped potential of LSTfi yield on Metis, via a hybrid CDP Stablecoin and Yield Market platform. Enabling collateralization of yield bearing assets on Metis to mint aUSD, the Metis native stable unit of account, coupled with a yield market for speculation on yield bearing assets. This will enable optimized LST liquidity and yield on Metis. Introductory article here.

VALUE PROPOSITION:

- With the introduction of their decentralized sequencer and $100m+ of grants, liquid staking is set to explode on Metis, with the launch of multiple METIS LSTs/LRTs.

- This creates an urgent need for LSTfi/LRTfi solutions where holders of new METIS LSTs/LRTs can deploy their holdings to access liquidity & amplify yields

- Althea Finance is meeting this need with the first all-in-one LSTfi/LRTfi solution for the Metis ecosystem

- This will combine a Prisma-style LST-backed CDP stablecoin and a Pendle-style yield market in one product to unlock liquid staking yield and liquidity on Metis.

- Finally, the THEA token at the heart of the Althea Finance ecosystem allows holders to earn revenue share, amplify rewards and participate in governance decisions.

UNIQUE FEATURES:

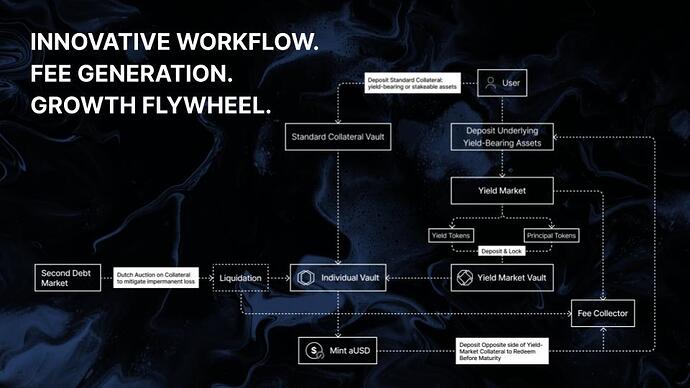

Bringing both a stablecoin and yield market solution together under one roof will also unlock a range of exciting synergies and innovations that have not been achieved by prior standalone products on the mainnet. For example, users will be able to deploy assets from our yield-market as collateral for minting aUSD to boost yields by leveraging Althea’s proprietary interest rates market. The unique structure of Althea Finance will allow it to emerge as the central hub of the entire Metis ecosystem, by offering:

- A Stable Unit Of Account: As a non-rebasing stablecoin with yield accrual upon redemption, aUSD can become the stable unit of account for the entire Metis ecosystem.

- A Foundation For Lending, Borrowing and Leverage: As the central stablecoin for Metis, aUSD will also unlock the potential for a variety of lending, borrowing and leverage options across the chain.

- Secondary Debt Market: Althea Finance will also have its own in-house secondary debt market, creating new arbitrage opportunities for users.

- LST Yield Aggregator: By accepting all yield-bearing assets as collateral, aUSD will become a de facto yield aggregator for the Metis liquid staking sector.

- Sustainable Revenues: Althea will have multiple revenue streams from minting fees, redemption fees and borrowing interest fees. This means it can provide a sustainable income for governance token holders and voting incentives for liquidity that don’t rely solely on the native token.

BENEFITS FOR USERS:

Metis recently made history by introducing the first ever decentralized sequencer on an Ethereum Layer 2. This paves the way for users to start staking their METIS tokens, stimulating demand for METIS LSTs, which will be supported by $100m of grants form the MetisDAO Foundation. In turn, the rise of METIS LSTs/LRTs will lead to a need for LSTfi solutions where METIS LST/LRT holders can access liquidity and amplify their yields.

Althea Finance will be the first all-in-one LSTfi solution for the Metis ecosystem, combining an LST-backed stablecoin with a native yield market to deliver everything Metis LST holders will need to maximize their yields and unlock liquidity. In addition the THEA token sits at the heart of the ecosystem offering rewards boosts, revenue share and governance rights.

Some of the key functionality that Althea Finance will offer to Metis users is:

- A Multi-Asset CDP Stablecoin: Holders of both METIS and METIS LSTs/LRTs will be able to mint aUSD.

- A Native Yield Market: A Metis native Pendle-style yield market allows users to speculate on the future yields of LSTs and other yield-bearing assets.

- Revenue Share: THEA holders who stake their tokens will receive 50% of protocol revenues from minting fees, borrowing fees, trading fees, redemption fees and more.

- Governance Rights: THEA stakers will also be able to vote on key aspects of the protocols functioning, including how rewards are allocated to protocol users.

- Rewards Boosts: Locking THEA tokens will also entitle holders to a multiple on any yields generated on the Althea protocol, plus revenue share and governance.

BENEFITS FOR METIS ECOSYSTEM:

To estimate the size of the potential market for LSTfi solutions on Metis, one need only look at how the LSTfi sector has flourished on the Ethereum mainnet. 4 of the top 10 projects by TVL on the Ethereum mainnet are LSTfi/LRTfi projects, with a combined TVL of $50bn+ across all LSTfi protocols.

With the MetisDAO Foundation allocating $100m in grants to fund its expansion, and LSTfi being the main focus, there is an unprecedented opportunity for first-movers to grab a similar market share. The entire value of LSTs lies in the fact that they make staked tokens and rewards liquid so that they can be used on further yield-bearing activities. Therefore as METIS LST offerings begin to go live on Metis, there will be an instant demand to put them to use.

Althea not only meets that need, but does so in a manner that will generate substantial and sticky TVL, liquidity, volume and yield, engaging DeFi users and keeping TVL on Metis. Furthermore Althea is built on tried and tested secure sustainable, and highly profitable architecture and business/revenue models from Ethereum mainnet (with our own innovative twists).

ROADMAP:

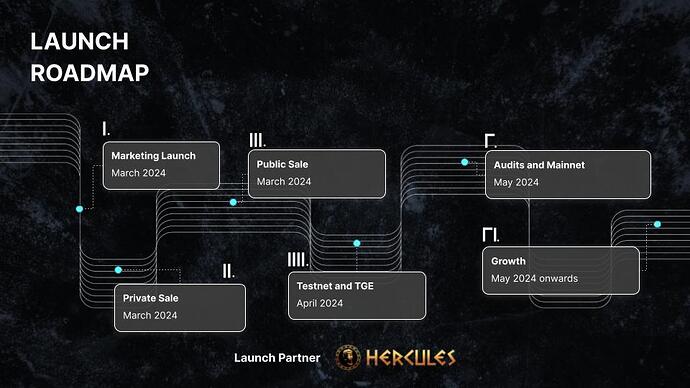

CVP and Metis grant submission, early supporters raise and IDO on Hercules DEX by end of March/early April. TGE, CDP testnet, initial audits, and mainnet launch BD and marketing kick off in April. Mainnet launch and ongoing DeFi integrations from May onwards.

SUMMARY:

METIS LSTs are coming to Metis! Ethereum has provided a blueprint for the potential. Users want liquidity, utility and optimized yield for their LSTs. Althea Finance brings two of the premier and proven models with an integrated Metis native CDP stablecoin and yield market. Based on proven revenue generating models, paired together to foster further unique innovation exclusive to Metis, and delivered by an experienced team. We’d love to connect with any fellow builders and active Metis ecosystem participants, so feel free to reach out on Twitter. Thanks for reading and we’re excited to build with you on Metis!

OFFICIAL LINKS:

- Website: https://altheafinance.com

- Twitter: https://twitter.com/altheafinance

- Docs: https://althea-protocol.gitbook.io/

- Deck: Althea Protocol Deck - Google Slides

- Team Bios: Althea Team Bios - Google Docs

- Tokenomics: Althea Tokenomics - Google Sheets