Introduction

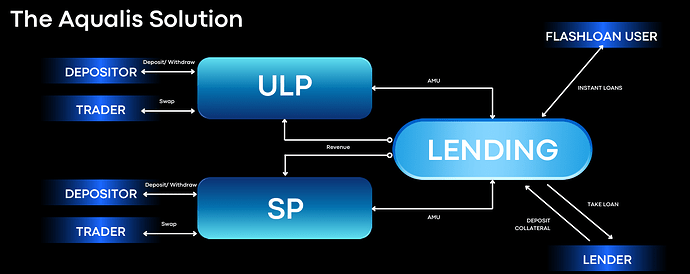

Aqualis Protocol is a lending-integrated decentralized exchange (DEX) designed to bring unparalleled efficiency and liquidity optimization to EVM ecosystems, starting with Metis as our first destination!

Our hyper-efficient liquidity pools not only enable seamless stablecoin trading but also maximize capital utilization through lending integration, ensuring liquidity earns yield from both trading fees and lending markets simultaneously.

The Aqualis ecosystem will initially feature two products, the stablepool (SP) for pegged assets such as LSTs and stablecoins, and the universal liquidity pool (ULP), compatible with all tokens.

Key Features of the Stablepool (SP)

- Pegged trading: to maximize capital efficiency, the SP no longer uses price impact for trades. Instead, it uses a variable trading fee centered around a peg

- Double utilization: earn from trading and lending revenue through our asset multi-utilization (AMU) algorithm, which is essentially a set of on chain rules to determine how much funds are required in trading and lending pools to maximize rewards

- Higher rewards: through double utilization, depositors can earn higher rewards than traditional DEXs and lending protocols

- Lower fees: by passing through a portion of the higher yield, Aqualis can deliver lower fees to the end user for both trading and lending

- Depeg protection: during a depeg, liquidity allocated to lending will be safe from impermanent loss due to our innovative depeg protection mechanism

Key Features of the ULP

- Compatibility: users can add LP, remove LP and trade any ERC20 token

- Continuous buy pressure: tokens paired with a lending enabled asset will result enjoy a permanent buy pressure from the compounding lending revenue, thus increasing the price of the token even when no one is buying

- Additionally, the ULP also offers the benefits of double utilization, higher rewards, and reduced fees mentioned above for the SP

Key Features of Aqualis Lending

- Simple over-collateralized lending market forked from Aave v3

- All integrations of SP and ULP done on the Aqualis side with zero changes to core battle-tested Aave v3 code

- Lower spreads than the existing Aave v3

- Lending liquidity supported by the SP and ULP, but users can interact at a lending-only level and deposit stablecoins directly on the lending protocol as collateral to borrow other assets

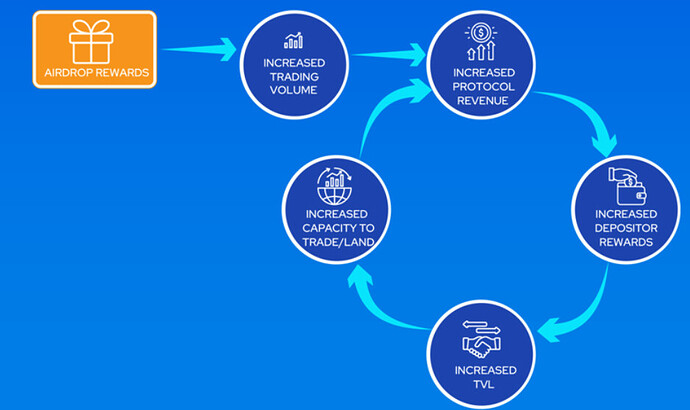

AQL Token Airdrop

Yield farming incentives target TVL but has no guarantee of transactions or protocol revenue. This is why Aqualis uses a trading based incentive to increase trading activity in the protocol, guaranteeing protocol revenue and on chain activity.

Value Proposition - for Users

- Airdrop farming: users can farm AQL tokens through trading, with Aqualis’ low trading fees and Metis’ low transaction fees, farming will be a breeze!

- Lower trading fees: average stablecoin trading fee of 0.01%

- Lower lending spread: lower lending spreads compared to Aave v3

- Higher rewards: double dipping rewards lead to higher APRs

- Diversified earnings: gone are the days of manually deciding to deposit USDT, USDC or DAI on lending platforms, with the SP you can earn a diversified yield across all 3 with a single deposit

Value Proposition - for Metis Ecosystem

- Increased transaction activity: airdrop farmers will likely put through massive amounts of transactions thanks to low trading and transaction fees

- Increased TVL: as airdrop farmers trade, APR will increase significantly leading to higher stablecoin TVL on Metis

- Reinforced stablecoin peg: less liquidity required to maintain stablecoin peg

- More Metis awareness: as we launch on new chains and push marketing, this will naturally spread awareness for Metis as well

Security and Audits

- Many weeks of initial testing

- Hashlock audit

- Further testing

- Hashlock re-audit (report currently being written)

- Hashlock bug bounty

- Public testing (where we are now)

Your Turn to Test!

Interested to see this in action? Now you can on the Metis testnet!

- Add the Metis Testnet (if you haven’t already)

- Visit the Aqualis testing site

- Get testnet Metis tokens from the Aqualis TG or the Metis testnet faucet

- If you are using our Telegram, use this command: /faucet metis

youwalletaddress - Get testnet stablecoins from the Aqualis faucet

- Start testing!

Roadmap

- Q4 2024: launch the Aqualis Stablepool (SP) on Metis Testnet

- Q1 2025: launch the SP on Metis Mainnet

- Q1 2025: Aqualis Protocol marketing push

- Q1 2025: begin AQL trading based airdrop campaign

- Q1 2025: launch the SP on several other EVM L1/2s

- Q1 2025: AQL token TGE on Ethereum, bridged to Metis

- Q1 2025: AQL staking

- Q1 2025: launch of the Aqualis Universal Liquidity Pool (ULP) on Metis Testnet

- Q2 2025: launch the ULP on Metis Mainnet

- Q2-3 2025: launch the ULP on several other EVM L1/2s

- Q4 2025: launch of AqualisDAO, giving more governance control to token

- Q1-4 2025: R&D for Aqualis v3 + on-chain options market