Capital Efficient Private Credit

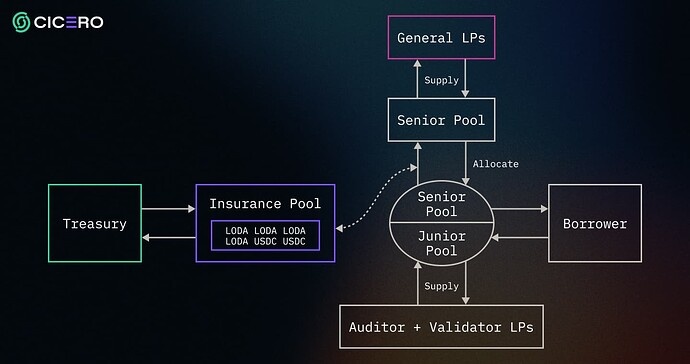

Cicero is a contract-to-contract credit market for institutional borrowers. Our design will use a multiple pool approach to both mitigate risk and attract different lending appetites.

Our core borrowers will be largely Web3 market makers, selected hedge funds as well off-chain opportunities such as property bonds (RWAs).

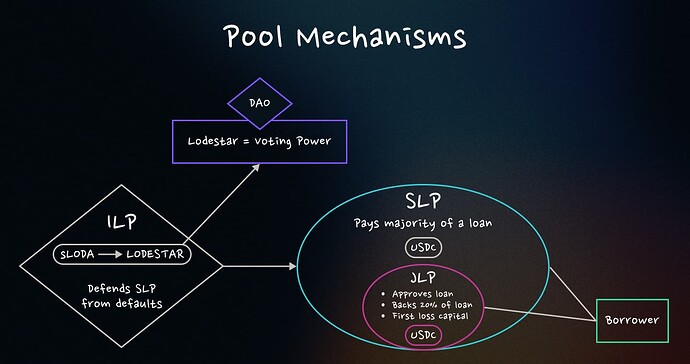

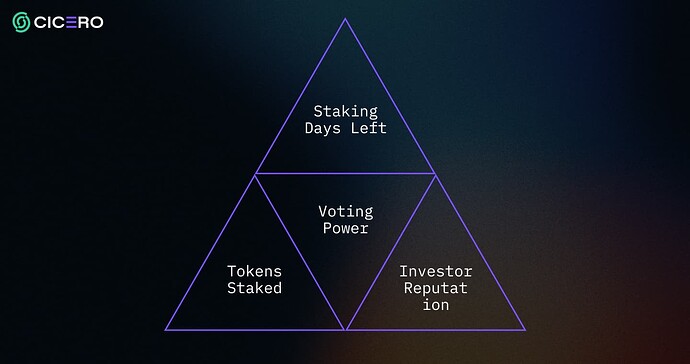

All governance decisions and underwriting will be made by staking Cicero. In addition to all governance decisions, staked Cicero can be used to reback loans in the event of defaults. To avoid governance manipulation, we will make sure of depreciating voting power (the closer you are to unstaking, the less voting power your tokens hold).

Mission

Cicero aims to be the destination for on-chain for institutional Web3 borrowing.

Our initial borrowers will be major market makers and select hedge funds.

In this model, many can lend but only few institutions can borrow.

Less counterparty risk means that lenders and token holders can have a more detailed understanding of the parties borrowing, and with this more peace of mind on how borrowed funds will be deployed.

By having multiple pools (senior and junior), lenders can deploy strategies to optimise yields based on individual risk tolerance.

The Importance of Capital Efficiency

The ability to lend and borrow assets is a cornerstone of any financial system.

Although overcollateralized lending is safer for the lender, it is not as capital efficient and thus limits market expansion.

In a nascent industry such as Web3/DeFi this ability to access capital is even more important so that the critical financial plumbing such as exchanges, OTC desks, and other brokerage models have the required liquidity for the market to function optimally.

These are all benefits on the borrow side, but under-collateralized models also have many benefits on the lend side as well, namely through attractive yields.

Due to the fact that under-collateralized loans are a higher risk to lenders than over-collateralized models such as Aave/Compound they also justifiably offer a higher Annual Percentage Yield (APY) return on deposit.

The market rates for capital fluctuate based on market cycles, but are always attractive, especially so when there is a higher demand for working capital such as during periods of market optimism.

By judiciously lending to only the most robust businesses in the industry, LPs get the advantage of higher yields, with the added benefit of knowing they are only lending to a very select group of well-established borrowers. This does not guarantee that loans will not default, but it does limit the amount of counterparties that lenders need to monitor and track repayments.

Selected Investors

Assessing risk

Cicero will work with trusted third parties to generate comprehensive on-chain credit scores and analysis.

Trustworthy creditworthiness data is used to estimate risk profiles of borrowers without disclosing sensitive information on blockchains.

At the outset loans will be approved by the core team to create initial flows and prove the model, however as we move towards true decentralization credit committees and allocators will be selected and made up from the staking pool.

Models that require a third party to approve loans can work, and do work, but without adequate financial penalty for defaults the incentive is almost always to approve loans.

We believe that a model where the users who are putting up the capital, can decide whether to fund or reject applications creates the right set of incentives to adequately underwrite loans, with the added benefits of keeping this value in the system (fees go to users, rather than an outside organisation).

Of course, no underwriting is perfect and defaults do occur - however having an extremely high bar to who Cicero will onboard as borrowers and with the protocol lenders can both select and use modular risk management when deciding how to allocate funds.

A post FTX / Voyager World

To address the elephant in the room, there may be some concerns around the sustainability of undercollateralized models due to fallouts and full collapses of Voyager, Celsius and Three Arrows Capital in the previous cycle which created enormous contagion across the interlinked crypto credit markets.

While these are valid concerns for all undercollateralized markets, we only need to look at the fact that the private credit market hit 2.1T globally in assets and committed value. This figure is larger than the entire crypto market by some margin.

This comparison to legacy markets implies an enormous growth potential for currently nascent under collateralized lending in Web3, where unsecured markets are a mainstay across all financial product segments.

As previously stated, capital efficiency is a core tenet to expanding markets, and when allocated correctly an extremely powerful instrument in any financial market.

More than Governance - Value Accrual of Cicero Token

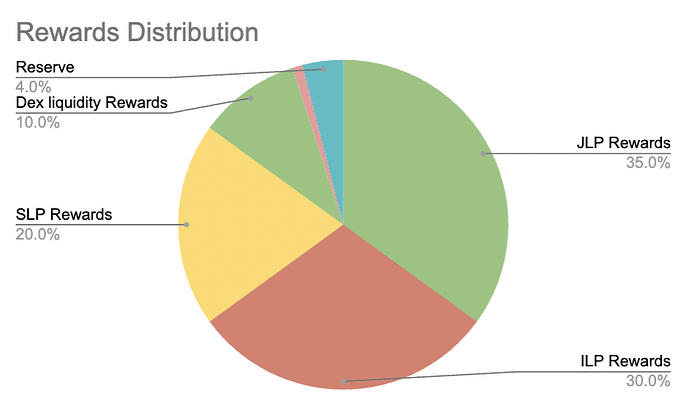

The critical role of the Cicero token will be work as backstop for the senior pool in the event of liquidations (when Cicero is staked). However incentives drive all human behaviour, and in order to create a sustainable protocol we must ensure that value is accrued and distributed back to the token holders.

Value Accrual is the process by which a token ecosystem creates and maintains demand over time, while transforming that demand into captured value retained by token holders. Demand is always the precursor to value (no matter what anyone says).

Most projects promise a design solution that achieves this, but very few actually deliver on promise.

A multitude of value accrual mechanisms exist, however only those that directly distribute value back to the token holders offer any truly tangible benefit. We are acutely aware of this problem within token design, and have taken steps to ensure that value is not only captured, but distributed to those who help the protocol function (liquidity, staking, governance, approving loans, etc).

The simple truth is that in order for a protocol to accrue value it must have demand for the service, and then divert some of that value to the protocol and in turn the token holders.

The value accrual properties of Cicero will be the function of three inputs:

- Real yield (repayments)

- Token buy-backs (buy pressure)

- Claimable fees (in ETH)

Below we will go into how all these mechanisms work in practice.

Real-yield (loan repayments)

It feels ridiculous to write this, but given that DeFi was originally dominated by frothy yield farms and food tokens, profitable protocols distributing organic revenue to token holders (such as GMX) have become increasingly popular.

The obvious benefit of money markets are that they generally always have borrow side demand, and that so long as the allocators are doing are good job, then the protocol captures revenue from monthly repayments.

Cicero has both a senior pool and a junior pool, where the senior pool is safer and the junior pools works are first loss capital. The yield for the LPs is reflected in the risk taken (so the junior pool earns more USDC and Cicero).

Native tokens can be used as an added incentive to increased yield and incentivize behaviour, but are non-essential to generating revenue.

Tokens are not necessary to create revenue, but they are an important tool to help the protocol reach velocity (in both sides of the loan book).

Buy-back (and pair)

Borrowing from MakerDAO smart burn mechanism, Cicero will also employ a similar strategy to both create buy-side pressure, as well as add liquidity to Cicero pairs on Uniswap.

Once Cicero treasury goes above a threshold (to be decided by community) then excess USDC collected from loan repayments will be used to purchase Cicero and deploy into the DEX trading pair.

Buyback and pairing this liquidity have two forms of value accrual.

-

Transforming revenue from the protocol (without selling Cicero) and using it to purchase Cicero on the market

-

Reducing the number of Cicero tokens on the market, effectively distributing that value that was just captured to all remaining tokens instantaneously and equally.

The simplest measure of a moat in the industry is liquidity, and for the token to appreciate buy-side liquidity. Achieving both buy pressure and added liquidity is a much more elegant solution than simply burning tokens (where the idea is to reduce the supply).

Burning tokens in and of itself does not create value accrual, in the same way that minting tokens does not constitute value creation. A token ecosystem only gains economic value when a token is acquired through economic means (buying from the market).

Claimable fees (in ETH)

Fees captured and held in treasury can be distributed to token stakers once above a certain threshold, and agreed to by stakers. In order to minimise inflation of the token, users can claim the fees in ETH, so as to not put counter-productive selling pressure on the protocol (this would be the opposite of value accrual, where value is actually being extracted from this system. This is a similar design to what GMX made so popular.

Real World Asset (RWA) Opportunities

Property bonds are preferred over real property as most investors don’t have to be concerned about the hassle of fluctuation in price, liquidity (buying/selling of the asset), ongoing maintenance and keeping up to date with legislation in multiple regions. Facilitating these assets on-chain with a focus towards shortened maturity dates are a unique RWA tokenized opportunity for crypto savvy investors that Cicero is currently exploring.

Innovation and Community Value

-Community based underwriting

-Depreciating voting power

-Multiple pool default security

Cicero emissions

Max supply: 100M

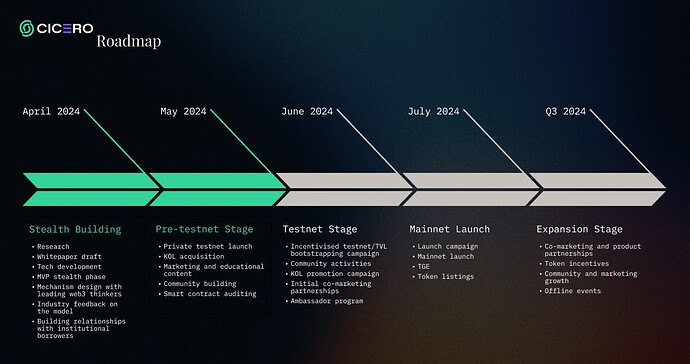

Pre-Launch Roadmap

Request for CVP Status

Given our innovative and methodical approach to Defi on Metis, adherence to security best practices and commitment to community engagement, we propose that Cicero be granted Community Verified Project status. This recognition will not only validate the work we have already done, but it will help bring further visibility to the project as we settle on a destination on where to launch our protocol. Having this surety allows us to focus on the next steps of go to the market, and in turn look to bring more activity to the Metis ecosystem.

Conclusion

Capital efficiency is paramount to any financial market’s ability to expand and work optimally.

-no underwriting is perfect, however creating the right incentives and equally disincentives should ensure that not only is allocation cautious, but also that the fees generated for approving loans is retained by participants in the protocol.

-The beauty of money markets is that they generate real yield immediately, and should always have borrow side demand. In a healthy money market, demand should outstrip supply.

-Taking appropriate care towards token accrual design is vitally important, however no amount of mechanism design can create and maintain token appreciation on its own.

-The only way to achieve this is to have a product that has genuine demand, which then captures value and distributes it to its token holders.

-We believe we have achieved these steps through meticulous planning and we now hope to work with the Metis community to help launch the product.

Official Links: Website, Docs.

Twitter: x.com

Docs: Notion – The all-in-one workspace for your notes, tasks, wikis, and databases.