CryptoTaxCalculator <> Metis Integration

https://cryptotaxcalculator.io/

Abstract

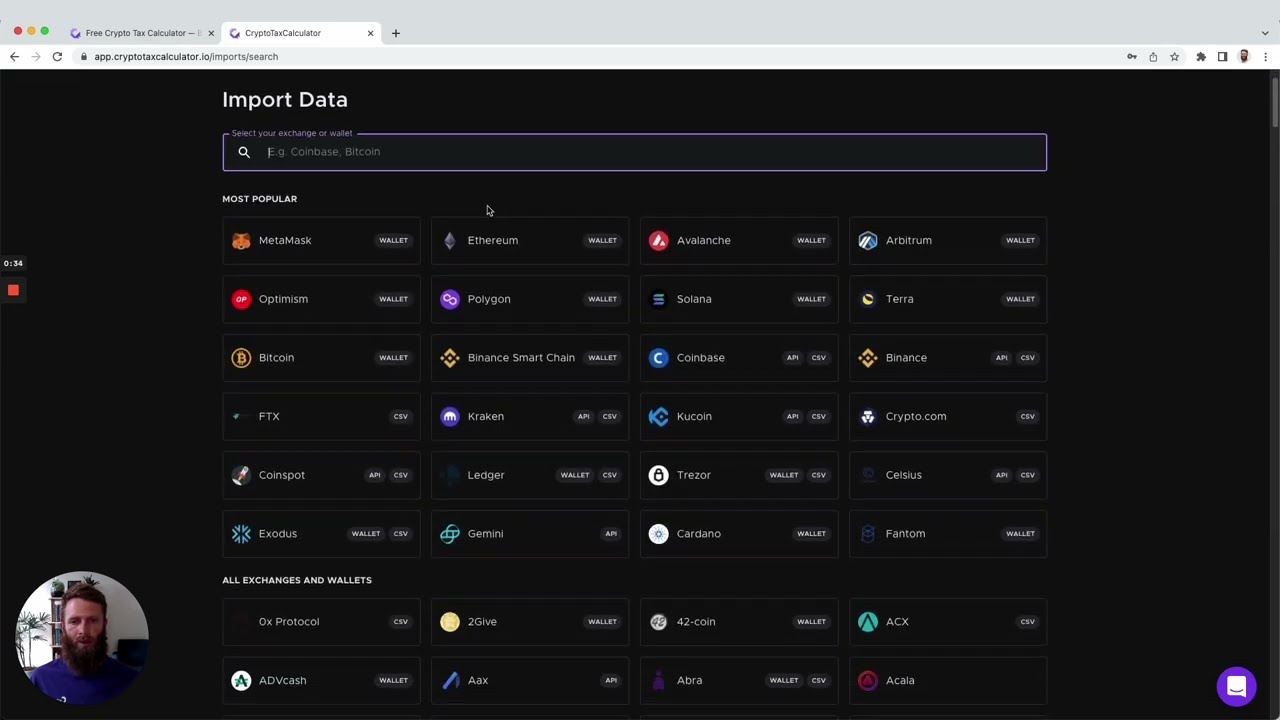

We help you sort out your tax nightmare. With 200k+ users, and support for 600+ integrations, it’s finally time for CTC (CryptoTaxCalculator) to integrate with Metis. This will allow Metis Users to import their transactions into CTC by simply pasting in their wallet address.

Video Demo:

Tech Utility:

If you’ve KYC’d anywhere, you’ll need to calculate your taxes. We’ve already built auto-categorisations and suggestions for 600+ integrations and 25+ countries. Allowing you to easily import all of your transactions into one platform, even if you’ve interacted across multiple chains or exchanges.

Unique Value Proposition:

We value ourselves on truly supporting DeFi. Whether you’ve just been hodling ETH, or using stETH as collateral to buy more ETH, which then bought an NFT, which you then deposited into an LP and are now staking that LP token to farm rewards daily, your transactions will be correctly imported into CTC. Simpy try importing your wallets into us and any of our competitors, you’ll see the difference straight away. Whether it’s our pricing oracle with covers 300k+ currencies, or our reconciliation view which gives you smart suggestions based on what smart contracted you interacted with and how, there’s a mountain of innovation at CTC.

Audits

Our app is completely off-chain. We don’t have any smart contracts, we don’t custody any assets, or have any on-chain presence. Regardless, we got awarded with our SOC2 compliance by Vanta, the industry standard for accounting tools.