Metlab to launch on Metis Network and Metis Network Initial Contribution to Liquidity

Introduction:

This proposal outlines the strategic partnership between Metis Network and MetLab, decentralized lending markets which focuses on yield amplification and capital utilization through innovative lending approaches.

What is MetLab?

MetLab is a DeFi platform designed to rationalize lending and liquidity by utilizing yield-bearing collaterals and advanced leveraging tools. It aims to aggregate the most attractive yield opportunities across the network, enabling users to maximize returns through various optimized strategies. MetLab emphasizes sustainability, long-term user engagement, and supports a wide range of collaterals to enhance safety and risk management.

Advantages and Excellence of MetLab:

-

Innovative Yield Optimization: Through the concept of “Infinite Money Loops,” MetLab allows for the amplification of initial capital by leveraging yield-bearing assets and reinvesting in yield-generating opportunities.

-

Diverse Asset Support: Accepting a variety of yield-bearing assets, MetLab creates specialized markets that enhance liquidity and offer users diversified asset management options.

-

Strategic Integration: MetLab integrates with LP markets, broadening the financial ecosystem and enabling users to use their LP tokens as collateral for further investments.

-

Enhanced TVL: MetLab’s approach to collateral diversification and competitive yields aims to significantly increase the Total Value Locked (TVL) within the Metis ecosystem.

MetLab role for the Metis Ecosystem:

TVL Gathering:

By utilizing yield-bearing collaterals and offering incentives, MetLab is expected to attract significant TVL to the Metis ecosystem, enhancing the network’s value and appeal.

Capital Utilization:

Users can leverage their yield-bearing collaterals for more efficient capital use, accessing stablecoin markets or engaging in strategic asset shorting.

Ecosystem Bootstrap:

MetLab’s close alignment with Metis Network and its focus on yield-bearing tokens present new opportunities for other protocols within the ecosystem, fostering innovation and growth, including yield bearing collaterals from other protocols and ability to build strategies on top of MetLab markets.

On-Chain Liquidity:

MetLab’s operational model will generate deeper on-chain liquidity for all utilized assets, including the MET token, by increasing trading volume through leverage and deleveraging activities, hence creating more incentive for liquidity providers.

Sticky Liquidity:

The token economics of MetLab incentivize long-term liquidity provision, likely resulting in more stable MET token liquidity and therefore long term yields for lending markets.

Example of Metlab leverage utilization

- Initial Deposit: A user starts by depositing funds into the METIS-USDT pool on the any dex. This is a primary way to generate yield on the platform.

- Leveraging Through MetLab: Next, the user takes the LP tokens received from the dex and uses them as collateral on MetLab. By doing so, the user can borrow additional tokens against their LP.

- Reinvestment for Enhanced Yield: The borrowed tokens can then be redeposited back into the LP, allowing the user to farm yields on a larger amount than the initial investment. This method amplifies the earning potential through compound farming.

Let’s consider hypothetical APRs for a clearer understanding:

• DEX LP APR: Assume an APR of 93% for providing liquidity in a METIS-USDT pool.

• MetLab Deposit Incentives: Metlab offers additional incentives for deposits, the base rate of 10% and additional 10% of emission incentives in MET token. This means, users earn additional yield on top of their LP yield, making the yield 113% APR.

• Borrow Interest for USDT: Borrowing USDT to leverage your investment might come with an interest rate of 15% per year.

• Attractive Deposit Rates: The interest paid by borrowers (e.g., for leveraging positions) creates attractive APR for other users, fostering a healthy lending and borrowing ecosystem.

Assuming the LP value of 100,000 USD, and LTV of 80% means that the user can leverage his position to 450,000 USD value.

Making it 450k deposit and 350k borrow.

Earning 113% APR for 450K, which makes 508,5k revenue.

While paying 15% for 350k borrow, which makes 52,5k.

Profit for the user would be 456k per year. Hence, effective APR for initial deposit would be 456%.

Numbers may differ and are subject to volatility, nevertheless, the market will self-balance as users will always monitor the yields.

Benefits and Engagement

User Engagement: The mechanics of leveraging and yield farming on Metlab encourage users to actively monitor and manage their investments daily. This constant engagement fosters a deep connection with the ecosystem.

Built for the Long-Term: Leveraged yield opportunities and the token economics of Metlab incentivize users to become long-term participants in the ecosystem, enhancing loyalty and sustained growth.

Ecosystem Growth: By facilitating such strategies, Metlab not only benefits individual users but also contributes to the growth and vibrancy of other protocols within the ecosystem, like Heremes, Netswap, Hercules, WAGMI, and others.

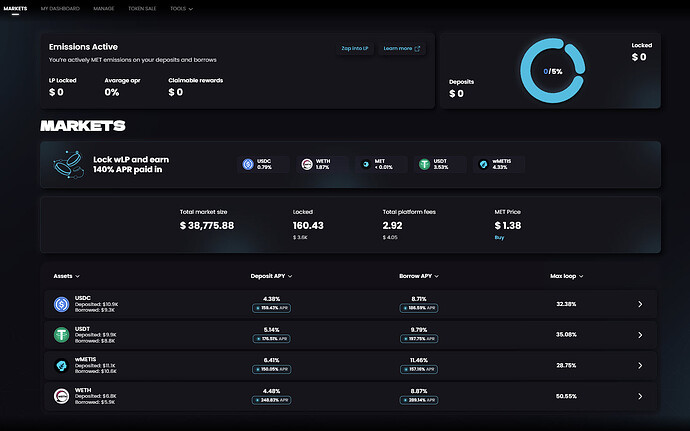

Platform preview:

Timeline:

Token sale - within 3 weeks of proposal pass

Protocol launch - within 3 weeks of proposal pass

Our links:

Dapp: https://metlab.xyz

Docs: https://docs.metlab.xyz/

Discord: MetLab

Telegram: https://t.me/metlabxyz

Twitter: https://twitter.com/0xMetLab

Conclusion:

The proposed partnership and initial network contribution are pivotal for accelerating MetLab’s integration within the Metis ecosystem, amplifying its benefits across DeFi, and setting a precedent for innovative financial solutions. We invite Metis Network to consider this proposal and join us in shaping the future of decentralized finance.