Introduction

StaFi protocol is the first liquid staking protocol for multiple POS blockchains. StaFi aims to solve the contradiction between Mainnet security and token liquidity in PoS consensus.

Users can stake PoS tokens through StaFi and receive rTokens in return, which are available for trading, while still earning staking rewards. rToken is a synthetic staking derivative issued by StaFi to users when users stake PoS tokens through StaFi rToken App . rTokens are anchored to the PoS tokens staked by users and the corresponding staking rewards. rTokens can be transferred and traded at any time.

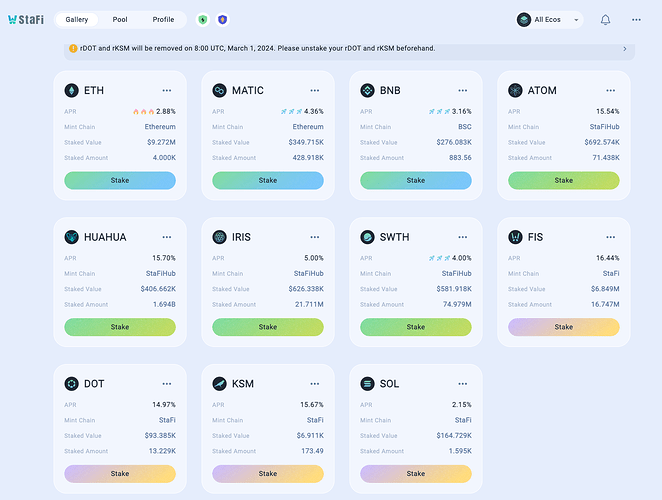

To date, the platform has released up to 10 various liquid staking solutions including rETH (StaFi Staked ETH), rMATIC, rBNB, rATOM, among others.

What is rMETIS and How it Works

Users can deposit METIS on the StaFi Protocol without any limitations based on their capacity. The deposited METIS is subsequently staked by StaFi’s staking contract, which autonomously selects the optimal sequencers to generate and maximize staking yields.

Users who deposit METIS on StaFi will receive an equivalent amount of rMETIS (rToken StaFi equivalent) to the value they staked. rMETIS is an erc20 and rebase token. Subsequently, users can freely trade rMETIS (rToken equivalent) or provide liquidity (LP) to earn additional yield. This additional yield can be staked alongside our reputable DEX partners on METIS.

Benefit

METIS Ecosystem

- Increase TVL and Grow METIS Liquidity

- New DeFi Use Case: stable coin and lending based on LST

- Improve the Network Security

METIS Holder and User

- More Yield

- More DeFi Use Case

Roadmap and Plan

- Submit and discuss rMETIS proposal on the StaFi rLaunchpad

- Technical research

- Discuss with METIS team

- rMETIS community voting

- Development(Contract, FE, BE)

- Launch on Testnet

- Launch on Mainnet

- DeFi Partner

- DeFi Integration

More

- Website: https://stafi.io

- rToken App: https://app.stafi.io

- Document: https://docs.stafi.io

- DeFilama: https://defillama.com/protocol/stafi

- Dune: https://dune.com/stafi-analysis/stafi

- Github: stafiprotocol · GitHub

- Audit: security/audits at main · stafiprotocol/security · GitHub

- rLaunchpad: New rToken on rLaunchpad - StaFi Protocol Governance