Introduction

StaFi protocol is a liquid staking protocol for multiple POS blockchains. StaFi aims to solve the contradiction between Mainnet security and token liquidity in PoS consensus.

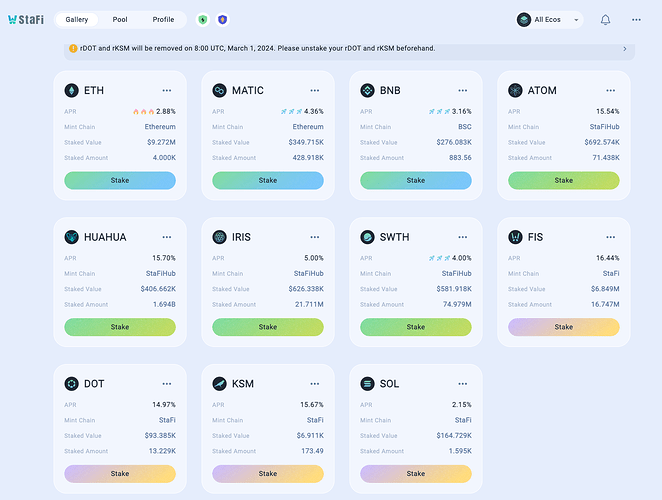

Users can stake PoS tokens through StaFi and receive rTokens in return, which are available for trading, while still earning staking rewards. rToken is a synthetic staking derivative issued by StaFi to users when users stake PoS tokens through StaFi rToken App . rTokens are anchored to the PoS tokens staked by users and the corresponding staking rewards. rTokens can be transferred and traded at any time.

To date, the platform has released up to 10 various liquid staking solutions including rETH (StaFi Staked ETH), rMATIC, rBNB, rATOM, among others.

Specification

CVP

Liquid Staking as a Service

StaFi 2.0 will introduce LSD development frameworks and Liquid Staking as a Service (LSAAS), supporting ETH, EVM, and CosWasm. This will significantly reduce the complexity of LSD development, enabling quick deployment. The framework will also support METIS and introduce Liquid Staking as a Service (LSAAS) for METIS.

Check more details: StaFi Staking Letter#3: StaFi 2.0 — StaFi

rMETIS

Users can deposit METIS on the StaFi Protocol without any limitations based on their capacity. The deposited METIS is subsequently staked by StaFi’s staking contract, which autonomously selects the optimal sequencers to generate and maximize staking yields.

Users who deposit METIS on StaFi will receive an equivalent amount of rMETIS (rToken StaFi equivalent) to the value they staked. rMETIS is an erc20 and rebase token. Subsequently, users can freely trade rMETIS (rToken equivalent) or provide liquidity (LP) to earn additional yield. This additional yield can be staked alongside our reputable DEX partners on METIS.

More

- Website: https://stafi.io

- rToken App: https://app.stafi.io

- Document: https://docs.stafi.io

- DeFilama: https://defillama.com/protocol/stafi

- Dune: https://dune.com/stafi-analysis/stafi

- Github: stafiprotocol · GitHub

- Audit: security/audits at main · stafiprotocol/security · GitHub

- rLaunchpad: New rToken on rLaunchpad - StaFi Protocol Governance