YieldFort is a groundbreaking DeFi platform that revolutionizes the way cryptocurrency holders can earn fixed yield and protect their capital. By simplifying complex financial instruments into user-friendly, fixed-income products, YieldFort makes DeFi accessible to all crypto investors. And we want to benefit Metis ecosystem by bringing YieldFort protocol to it.

The platform offers easy-to-understand, mass-market products that provide fixed income on BTC and ETH, as well as Dollar Value Protection against market fluctuations. YieldFort achieves this by employing classic trading strategies, such as protected iron condors or butterflies, and leveraging options exchanges like Deribit and deltatheta.

YieldFort’s mission is to democratize access to these opportunities, empowering retail investors to participate in sophisticated investment strategies previously reserved for elite players.

Decentralization

The project is currently undergoing a transformation process from a centralized protocol to a DAO. With each stage of the transformation process, DAO will assume a larger part of the management and control, ultimately leading the platform to become a completely decentralized product.

Key Features:

-

Innovative Mechanisms: YieldFort focuses on developing a user-friendly interface that simplifies the process of investing in structured products. The platform bridges liquidity from Deribit, the world’s largest options exchange, into the DeFi ecosystem, enabling users to mitigate losses from volatility.

-

Fee Structures: Users act as liquidity providers (LPs) and earn token rewards for their participation. They pay product fees and withdrawal fees, which help maintain the platform’s sustainability and incentivize long-term investment.

-

Rewards and Incentives: YieldFort implements a points-based system that rewards users based on their tenure and the liquidity they provide. These points can later be converted into tokens, offering users additional benefits and incentives.

-

Token Utility: YieldFort’s native token allows users to access a wider range of products with varying risk levels. By burning tokens, users can improve their fund placement terms, such as increasing yield in fixed products. Tokens can also be used to pay various protocol fees, further enhancing the token’s utility.

Key benefits:

- Fixed-yield product specifically designed for Ethereum and Bitcoin holders

- Weekly extension options tailored to your investment needs

- Choice of options with or without capital protection

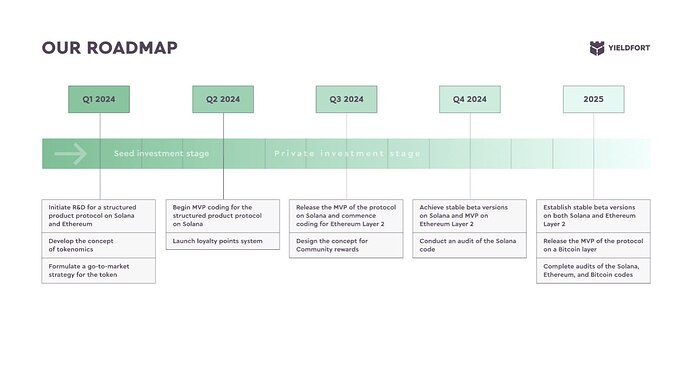

Roadmap:

Links

2 Likes

Looks interesting. Do you have any plans of launching new products? Like specifically Metis-related?

1 Like

Thanks! We consider Metis as one of the most promising L2s (by the way, congratulations to the community and team on the launch of the decentralized sequencer), and we strive to facilitate access to structured products for users of each network and allow users to hold crypto assets without worrying about losing value in dollar terms. Right now, we work with native ETH/BTC, but we’re open to adding support for METIS and stablecoins too.

As for the launch of new products, this is one of the reasons for launching the DAO. We want to enable the community to propose new interesting strategies that we can include in the Yieldfort ecosystem.

1 Like

Great questions, thanks!

- What is the primary goal of YieldFort 2 in the DeFi space, and how does it aim to achieve this goal on the metis ecosystem?

The primary goal of Yieldfort 2 is still to provide fixed income and dollar value protection to cryptocurrency holders in the DeFi space in a decentralized way. We aim to achieve this on the Metis ecosystem by leveraging its fast transaction speeds, low fees, and robust community. Also we see Metis as one of the most promising L2. Building on Metis allows us to offer our structured products more efficiently and cost-effectively.

- Could you explain how YieldFort provides fixed income and Dollar Value Protection to cryptocurrency holders, and what trading strategies does it utilize for this purpose?

Yieldfort provides fixed income and dollar value protection through market-neutral options strategies. We use three key strategies (you can find more info about each here):

- Long Call Butterfly: Buying one call option at a certain strike price, selling two call options at a higher strike price, and buying another call option at an even higher strike price. This strategy profits if the underlying asset price remains stable.

- Iron Condor: Selling a call option and a put option at higher strike prices, combined with buying a call option and a put option at lower strike prices. This strategy profits if the underlying asset price stays within a specific range.

- Iron Butterfly: A combination of Short Straddle (selling a call and a put at the same strike price) and Long Strangle (buying a call and a put at different strike prices). It profits if the price moves little around the strike.

We apply dynamic delta-gamma hedging to manage positions. Unlike most protocols that trade directional strategies (e.g., covered calls) and risk reducing the underlying asset, our goal is to increase the base asset in any strategy we use.

- Can you elaborate on YieldFort’s journey towards decentralization and the role of DAO in its transformation process from a centralized protocol to a fully decentralized platform?

The main role of the DAO is to tokenize the management of business development and distribute profits generated by the protocol.

The DAO members will be able to:

-

Select new investment strategies: The DAO will be responsible for identifying new strategies to diversify Yieldfort’s offerings and optimize returns for users;

-

Choose partner protocols and platforms: The DAO will seek out and onboards strategic partners to expand Yieldfort’s ecosystem and create new opportunities for growth;

-

Participate in liquidity incentives: The DAO will engage in initiatives to attract liquidity to the platform, such as liquidity mining programs, to enhance overall stability and profitability.

-

Distribute protocol profits: The DAO will govern the allocation of profits generated by the protocol, ensuring a fair and transparent distribution among stakeholders.

As Yieldfort continues to evolve, the DAO will take on an increasingly central role, ultimately resulting in a fully decentralized governance model that aligns the interests of all participants.

We’re excited about the future of Yieldfort 2 and the opportunities it presents for cryptocurrency holders in the DeFi space. If you have any further questions or would like to discuss our project in more detail, please don’t hesitate to reach out.

Thank you for your interest in Yieldfort!

1 Like